Sotatercept: A Game Changer for Merck and the Pulmonary Arterial Hypertension Market

Introduction

Sotatercept, a groundbreaking drug developed by Merck, is currently under review by the U.S. Food and Drug Administration (FDA). The decision, expected in March 2024, is eagerly awaited by both the medical community and investors. This drug could significantly impact the financial market for Merck and revolutionize the treatment landscape for Pulmonary Arterial Hypertension (PAH).

What Makes Sotatercept Novel?

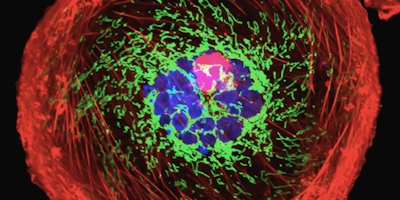

Sotatercept stands out due to its unique mechanism of action. It is a first-in-class drug that acts as a ligand trap for members of the transforming growth factor-beta superfamily. This means it binds to activins and growth differentiation factors, restoring balance between growth-promoting and growth-inhibiting signaling pathways. This innovative approach has the potential to address the unmet need for disease-modifying therapies in PAH.

The development of Sotatercept is based on years of research into the pathophysiology of PAH. The disease is characterized by an imbalance in the growth of cells in the pulmonary arteries, leading to their narrowing and increased resistance to blood flow. By targeting the growth factors that contribute to this imbalance, Sotatercept offers a novel approach to treatment that could potentially modify the course of the disease.

The Potential Impact on Merck’s Financial Market

The approval of Sotatercept could significantly boost Merck’s earnings. Financial analysts estimate risk-adjusted sales of $700 million five years after launch, rising to around $2 billion in 2033. The revenue for Sotatercept is expected to reach an annual total of $3.9 billion by 2036 in the US. This could be a significant contribution to Merck’s bottom line and could potentially increase its market share.

The approval of Sotatercept would also likely have a positive impact on Merck’s stock price. The pharmaceutical industry is highly competitive, and the introduction of a novel, first-in-class drug could give Merck a significant advantage. Investors are likely to respond positively to the approval of Sotatercept, leading to increased demand for Merck’s shares and a potential rise in their price.

Competitor Drugs

While sotatercept is still investigational, several other drugs are used in PH management:

- Endothelin Receptor Antagonists (ERAs):

- Bosentan (Tracleer)

- Ambrisentan (Letairis)

- Macitentan (Opsumit)

- Phosphodiesterase-5 Inhibitors (PDE5i):

- Sildenafil (Revatio)

- Tadalafil (Adcirca)

- Prostacyclin Analogues:

- Epoprostenol (Flolan)

- Treprostinil (Remodulin)

- Iloprost (Ventavis)

- Stimulators of Soluble Guanylate Cyclase (sGC):

- Riociguat (Adempas)

The Market Size for Sotatercept

If approved, Sotatercept is set to become a leading therapy in the PAH market. The revenue for Sotatercept is expected to reach an annual total of $3.9 billion by 2036 in the US. This suggests a significant market size and potential for growth. The approval of Sotatercept could open up new opportunities for Merck in the PAH market, which is currently dominated by a few key players.

The market for PAH treatments is expected to grow in the coming years, driven by an aging population and increased awareness and diagnosis of the disease. The introduction of Sotatercept could further stimulate this growth by offering a new treatment option for patients. With its novel mechanism of action and potential to modify the course of the disease, Sotatercept could attract a significant share of this growing market.

Conclusion

The approval of Sotatercept could mark a significant milestone for Merck and the PAH market. With its novel mechanism of action and potential to fulfill an unmet need, Sotatercept could transform the treatment landscape for PAH and significantly boost Merck’s financial performance. The anticipation surrounding the FDA’s decision reflects the high stakes involved, both for patients awaiting more effective treatments and for investors watching Merck’s financial prospects.

The potential impact of Sotatercept extends beyond its financial implications for Merck. If approved, it could offer hope to thousands of PAH patients who currently have limited treatment options. By potentially modifying the course of the disease, Sotatercept could improve the quality of life for these patients and reduce the burden of PAH on healthcare systems.

Merck financial performance: analysts’ ratings (Feb 2024)

Merck & Co., Inc., a global healthcare leader, has shown promising performance in the stock market. As of February 2023, Merck’s stock price reached an all-time high. Over the past 12 months, the total return for Merck’s stock was impressive, and it’s up significantly this year. The company’s market capitalization stands at a substantial amount. Analysts have given Merck’s stock a “Strong Buy” rating, with a 12-month stock price forecast that suggests growth. This positive performance reflects Merck’s strong financial health and its potential for future growth, making it a noteworthy consideration for investors.

Merck’s Financial Performance: Navigating Market Challenges

Introduction

Merck & Co., Inc. (commonly known as Merck) is a global pharmaceutical company with a rich history of innovation. In this blog post, we’ll delve into Merck’s financial status, recent performance, and key considerations for investors.

Understanding Merck

Merck operates in various therapeutic areas, including oncology, vaccines, infectious diseases, and cardiovascular health. As a research-intensive biopharmaceutical company, Merck continually strives to improve patient outcomes.

Recent Financial Highlights

Let’s explore Merck’s recent financial performance:

- Revenue Growth: In 2022, Merck’s revenue reached $59.28 billion, a 21.72% increase compared to the previous year’s $48.70 billion. This growth reflects the company’s robust product portfolio and strategic initiatives.

- Earnings: Merck’s earnings in 2022 were $14.52 billion, marking an 11.27% increase. These strong earnings demonstrate Merck’s ability to navigate market challenges effectively.

Share Price Trends

- Total Return: Over the past 12 months, Merck’s stock has delivered a total return of 20.33%. Year-to-date, it’s up 18.74%.

- Dividend Yield: Merck’s attractive dividend yield (approximately 6.3%) appeals to income-seeking investors.

Key Considerations for Investors

- COVID-19 Impact: Monitor the impact of COVID-19-related products on Merck’s revenue. As demand fluctuates, it may affect the stock price. Consider Pfizer as an example that lost revenue due to reduced demand for COVID vaccines.

- Earnings Estimates: Keep an eye on quarterly earnings reports. Be cautious if Merck misses estimates, but consider the long-term potential.

- Technical analysis: at the time of writing this article Merck’s stock price is at its all time high which provides a good opportunity for short-term investors but not for long-term investors. Keep an eye for potential pull back if you are not a patient investor.